|

![Click here to view (new window/tab)]()

| How HMRC Christmas tax rules trip up festive side hustlers

Don’t let tinsel hide tax ...

|      |

![Click here to view (new window/tab)]()

| Do I need to file a self-assessment tax return?

What to know before the 31st of January ...

|      |

![Click here to view (new window/tab)]()

| Salary sacrifice changes set to hit millions of UK employees

What the new cap could mean ...

|      |

![Click here to view (new window/tab)]()

| Nine ways to beat the Budget tax burden this year

Practical moves to keep more ...

|      |

![Click here to view (new window/tab)]()

| Why splitting a business to avoid VAT can backfire badly

Think long-term, not loopholes ...

|      |

![Click here to view (new window/tab)]()

| Chancellor eyes pension salary sacrifice: a £5.1bn question

Rumours, risks, and what’s at stake ...

|      |

![Click here to view (new window/tab)]()

| Why farmers need an inheritance tax transitional gifting rule now

A timely fix for ageing business owners ...

|      |

![Click here to view (new window/tab)]()

| Inheritance Tax risk for family-owned businesses: act before reliefs shrink!

Protect the legacy now ...

|      |

![Click here to view (new window/tab)]()

| A pension tax raid would put the NHS in danger

Why policy choices could backfire ...

|      |

![Click here to view (new window/tab)]()

| HMRC launches real-time HICBC payment for smoother PAYE

A friendly update for busy higher earners ...

|      |

![Click here to view (new window/tab)]()

| Are directors' loans a good cash flow strategy or just another tax trap?

Liquidity with strings attached ...

|      |

![Click here to view (new window/tab)]()

| Salary or Dividends: Optimising Income for Directors

Navigating financial choices wisely ...

|      |

![Click here to view (new window/tab)]()

| Should Directors Use Salary Sacrifice To Reduce Income Tax And National Insurance?

Smarter pay planning for owners and leaders ...

|      |

![Click here to view (new window/tab)]()

| UK Unveils Amnesty For Covid Loan Debtors: Your Last Clean-Slate Chance

Pay back quietly, avoid tougher action later ...

|      |

![Click here to view (new window/tab)]()

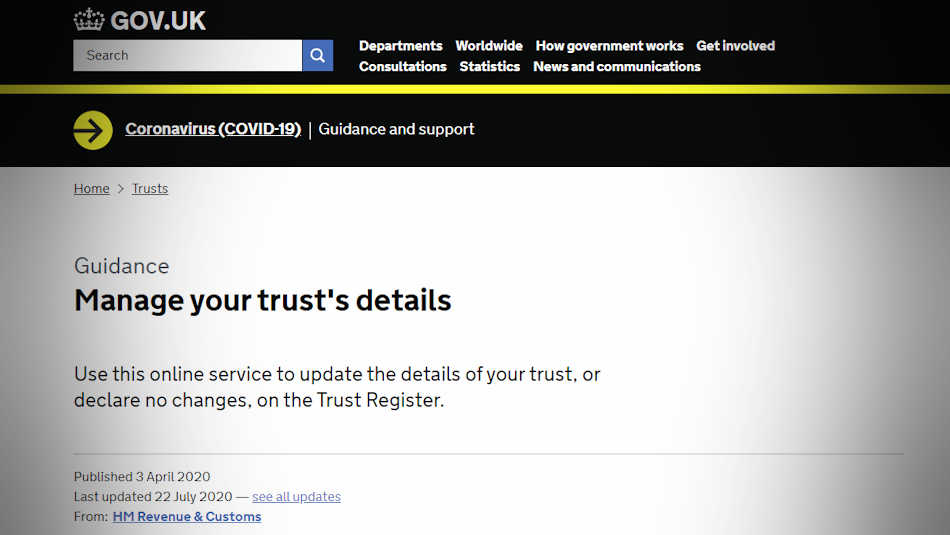

| Understanding The 10-Year Charge On Trusts Without The Headaches

What trustees need to know ...

|      |

![Click here to view (new window/tab)]()

| HMRC Pension Relief Crackdown: What Higher-Rate Taxpayers Need To Know

Tighter checks and proof for claims from 2025 ...

|      |

| HMRC Taking A Good Look At Savvy Online Sellers

Thriving in the world of online commerce ...

|      |

![Click here to view (new window/tab)]()

| Why Inheriting A Pension Could Become Painfully Taxing

What families should plan for now ...

|      |

![Click here to view (new window/tab)]()

| Rethinking Taxation: The Case for Taxing Income from Wealth, Not Work

A fairer approach to taxation?

|      |

![Click here to view (new window/tab)]()

| HMRC Warns Against Stamp Duty Rogue Agents: Stay Vigilant!

Protect yourself from misleading claims ...

|      |

| The Ins and Outs of Employing Young People

Consider their age first ...

|      |

![Click here to view (new window/tab)]()

| Unpacking the Property Tax Advantages of Being Married

Exploring the financial benefits of marriage ...

|      |

![Click here to view (new window/tab)]()

| Exploring Alternatives to a Wealth Tax: Practical Solutions for Raising Revenue

Rethinking taxation strategies for the UK ...

|      |

![Click here to view (new window/tab)]()

| New Regulations to Fine Crypto-Investors £300 for Non-Disclosure

Navigating the changing landscape for crypto-users ...

|      |

![Click here to view (new window/tab)]()

| Understanding Side Hustle Taxation: Essential Tips from HMRC

Navigating your tax obligations ...

|      |

![Click here to view (new window/tab)]()

| The Dangers of Raising Capital Gains Tax Rates at the Autumn Budget

Navigating the risks of increased tax rates ...

|      |

![Click here to view (new window/tab)]()

| Tax Freedom Day Falls Three Weeks Later in 2025

Analyzing the Impact on British households ...

|      |

![Click here to view (new window/tab)]()

| Unlock Extra Income with the Rent A Room Scheme

Boost your earnings with a lodger ...

|      |

![Click here to view (new window/tab)]()

| How VAT on Private School Fees Triggered a 22.6% Rise in Education Costs

The ripple effects of tax on fees ...

|      |

![Click here to view (new window/tab)]()

| Trusts Did Not Benefit Family in £442k Inheritance Tax Case

Examining a landmark inheritance tax decision ...

|      |

| Maximising Tax Relief on Pensions

How to optimise your contributions ... |      |

| The Future of Small Pension Pots

Consolidation for better savings ... |      |

| Stamp Duty: The £6.6M Property That Cost An Extra £475K

A cautionary tale ... |      |

| More Than 1.1 Million Savers Affected by New Tax on Savings

If in doubt, reach out to HMRC ... |      |

| The Perils Of Gifting Cash To Your Children

It can be a real tax trap ... |      |

| Do You Need To Make A Voluntary Disclosure To HMRC?

It's important to get the right advice ... |      |

| Time is Running Out to Top Up Your State Pension

Don't miss out ... |      |

| Writing Life Insurance in Trust Can Benefit Your Estate

Navigating the new Inheritance Tax regime ... |      |

| ATED: Annual Tax On Enveloped Dwellings Deadline

It's fast approaching ... |      |

| Don’t Miss Out on Your Tax Free Allowances

The 5th of April will soon be here ... |      |

| Many Electric Vehicle Owners Unaware of Looming Road Tax

You'll have to pay £195 from April ... |      |

| Understanding Deeds of Variation

A path to effective post-death tax planning ... |      |

| Inheritance Tax: Understanding Double Taxation Risks for Pensions

New IHT rules will soon apply ... |      |

| HMRC: Important Updates on Disguised Remuneration

Will you be included in the McCann review? |      |

| Understanding HMRC's Compliance Priorities For 2025

Stay informed and compliant ... |      |

| HMRC Encourages Voluntary Disclosures for R&D Tax Relief Over-Claims

Ensuring that you're compliant ... |      |

| HICBC: A Guide for Separated Families

Being proactive in a tumultuous time ... |      |

| Wishing You All A Very Merry Christmas

Here's some fun tax trivia for you ... |      |

| A Strategic Approach to Cost Management Using Salary Sacrifice

Not merely a reactionary measure ... |      |

| Double Cab PickUps Are Still Vans And Not Cars!

The Government performs a screeching u-turn ... |      |

| HMRC: Timely compliance is crucial for landlords

Heed the warning ... |      |

| Navigating the complexities of changing CGT rates

Business owners need a strategy ... |      |

| R&D Tax Relief: Common Pitfalls And How To Avoid Them

Prepare, document and comply ... |      |

| How A Bathroom Access Issue Cost £64k In MDR

The importance of clear separation and accessibility ... |      |

| A Closer Look At Possible National Insurance Changes

The first Labour budget is looming ... |      |

| Address Any Missing National Insurance Contributions Soon!

And get the maximum state pension ... |      |

| Anticipating Increasing Employee Costs In The Budget

Businesses can adapt ... |      |

| Could You Be Eligible for a State Pension Increase?

A guide for UK taxpayers ... |      |

| High Earners in the UK May Need To File A Tax Return

HMRC are looking at your 2021/22 income ... |      |

| EIS and VCT Extension Has Been Confirmed

Boosting the entrepreneurial ecosystem ... |      |

| More Families Facing Shocking Inheritance Tax Bills

Beware the seven year rule ... |      |

| Top Tips To Beat The Dividend Tax Trap

How to reduce your tax on dividends ... |      |

| The Student Loan Threshold Is Frozen Until 2027

What it means for students ... |      |

| HMRC Cracks Down on Crypto Tax Evasion

Are you a tax slacker? |      |

| Furnished Holiday Lets in UK Face Tax Hike From April 2025

What can landlords do? |      |

| PSAs: The Gift That Keeps on Giving for Employers

Motivating your employees the easy way ... |      |

| Understanding the Benefits of Patent Box

Why don't more businesses claim it? |      |

| Now Labour Are In Government What Tax Rises Are Coming?

The Chancellor doesn't have much wiggle room ... |      |

| HMRC Warn Of CGT Penalties for One-Off Transactions

Potential changes are on the horizon ... |      |

| Thousands of Pensioners May Be Eligible for DWP Refund

Are you owed money from the Government? |      |

| VAT On Holiday Lets And Serviced Accommodation

Is your income over the VAT threshold? |      |

| Are Hybrid Working Expenses Tax Deductible?

A guide for UK professionals ... |      |

| Election 2024: Potential Tax Changes Coming Within 100 Days

Who's proposed what? |      |

| Child Benefit for 16-Year-Olds In Further Education

What parents need to know ... |      |

| ERS: What Are Employment Related Securities?

And what actions do I need to take? |      |

| How Reduced CGT Allowance Puts Crypto Investors At Risk

Protecting your crypto investments ... |      |

| Understanding Self-Assessment Late Filing Penalties

Up to £10 per day ... |      |

| Working From Home And Commuting

HMRC clarifies the tax rules ... |      |

| Essential Tax Tips: How to Grow Your Pension

And beat the stealth tax ... |      |

| P11D: Focus On Staff Entertaining

Are you reporting it correctly? |      |

| Maximising Your Tax Savings as an Airbnb Host

How to stay on the good side of HMRC ... |      |

| The Future of Furnished Holiday Lets in the UK

Start planning for the potential impacts ... |      |

| New Cap On High Income Child Benefit Charge

Changes in the Spring Budget 2024 ... |      |

| Changes To Research And Development Tax Relief

What you need to know ... |      |

| HMRC Targets The Unrepresented in Basis Period Reform

It's a positive change for most ... |      |

| The Rise In Inheritance Tax Penalties

What you need to know ... |      |

| The Government Is Facing Pressure To Scrap HICBC

What you need to know ... |      |

| Should You Set Up A Trust Or Family Investment Company?

There are pros and cons for both ... |      |

| Builder Wins Private Residence Relief Case Against HMRC

Always maintain accurate records ... |      |

| Claiming Child Benefit in the UK Just Got Easier

A guide for new parents ... |      |

| Director Loans And Breathing Space Under S455

A useful tool for directors ... |      |

| Evading Tax Penalties on Excessive Director's Loan Accounts

Do you use your director's loan account? |      |

| Is the End Near for Members Voluntary Liquidation?

Exploring the potential changes ... |      |

| HMRC Targets Businesses in Crackdown on Electronic Till Fraud

Takeaways and restaurants beware ... |      |

| HMRC and the Taxation of Cryptoassets

Different rules for individuals and companies ... |      |

| Seven Key Tax Planning Points for SMEs To Watch

Developing the right knowledge and strategies ... |      |

| Rising Interest Rates Provide A Boost For Savers

But they may need to pay more tax ... |      |

| Deadline for DIY Housebuilders VAT Scheme Extended

A step towards simplifying the process ... |      |

| How UK Landlords Are Enjoying Record-Breaking Income

It's always been a popular investment ... |      |

| Beware Of Tax Imposters Offering Rebates

A friendly reminder ... |      |

| COVID-19 And The Impending Surge in Director Bans

For misusing government pandemic support ... |      |

| An Overview Of The Benefits Of EIS And SEIS

Helping to boost innovation ... |      |

| Are You Due A National Insurance Refund On Car Allowances?

How the recent upper tribunal decision may impact you ... |      |

| Navigating UK Inheritance Tax For Overseas Investors

A comprehensive guide for non-residents ... |      |

| VAT For The Rent To Serviced Accommodation Business Model

Insights from Sonder Europe Ltd vs HMRC ... |      |

| HMRC: Renovating a Home Does Not Make It Uninhabitable

Stamp duty rebate denied ... |      |

| Limited Company Ownership in the Buy-to-Let Market

Tax benefits drive landlords toward corporate structures ... |      |

| Landlords Rethink Property Investments Amid Tax Changes

There's been a rise in property disposals ... |      |

| HMRC Wins Appeal Over Capital Gains Tax Discrepancy

Due to an evident lack of knowledge ... |      |

| Paying For Employee Eye Tests

Has HMRC gone a bit cross-eyed? |      |

| Tax Debt Is Rising As Small Businesses Struggle To Pay

And business failure rates are increasing too ... |      |

| The Normal Expenditure Out Of Income Exemption

A valuable Inheritance Tax relief ... |      |

| HMRC To Gather More Information From Taxpayers

Commencing in 2025/26 ... |      |

| Guide To Tax-Efficient School Fee Planning In The UK

Ensure any planning aligns with tax legislation ... |      |

| Tax Issues For Estates In Administration

Things to be aware of ... |      |

| HMRC Nudge Letters: Now It's The Turn Of PSCs

The HMRC Wealth Team have their eye on you ... |      |

| What Are Some VAT Traps For Holiday Lets?

The challenges are ever-present ... |      |

| HMRC Writing To Taxpayers Named In Pandora Papers

Unveiling hidden financial secrets ... |      |

| HMRC Increases Interest Rate

In line with the Bank of England ... |      |

| IR35 Blunders Lands UKRI with £36M Tax Bill

Paying the price for historic errors ... |      |

| Revamping The Construction Industry Scheme

HMRC's simplification effort ... |      |

| Government Reviewing Dodgy Rent-To-Rent Market

Strengthening protections for landlords and tenants ... |      |

| Charitable Giving: An Effective Strategy for Tax Reduction

Three methods to minimise your tax liability ... |      |

| Fraudulent HMRC Legal Claim Calls Are Still Common

Be vigilant and cautious ... |      |

| New Holiday Let Registration And Planning Scheme

Will it boost local affordable housing? |      |

| SDLT: Potential Changes Following HMRC Consultation

What's on the horizon? |      |

| Gaps In Your National Insurance Records?

Make a voluntary payment soon ... |      |

| IHT: Tax Considerations When Making Gifts To Grandchildren

A great way to shrink your estate ... |      |

| Why Should You Use A Property Tax Advisor?

Don't leave things too late ... |      |

| Thousands Miss Out On Tax Free Childcare

Are you eligible? |      |

| End Of Year Tax Planning Checklist

8 ways to reduce your tax bill ... |      |

| HMRC Sends Nudge Letters To Gig-Economy Workers

They could be using dirty data though ... |      |

| Should Inheritance Tax And Income Tax Be Paid On Pensions On Death?

My view on potential reforms ... |      |

| Practical Implications Of The Class 2 NIC Changes

How does it affect low-profit traders? |      |

| Navigating Company Car Taxes: Alternatives to Going Electric

These strategies could be more beneficial ... |      |

| Capital Gains Tax: Positive Changes On Separation And Divorce

No gain, no loss ... |      |

| HMRC Delays MTD For ITSA

This will be welcomed by many ... |      |

| Taxpayers To Lose Millions In Unclaimed Tax Deposits

Another potential stealth tax ... |      |

| HMRC Increases Interest Rate On Late Paid Tax

It could go up again soon ... |      |

| Have You Fully Declared The Loan Charge?

HMRC may be coming after you ... |      |

| Capital Gains Tax On Divorce

Will you be liable? |      |

| Inheritance Tax: Gifts Out Of Income A Very Valuable Relief

As long as you can maintain your usual standard of living ... |      |

| HMRC Is Writing To Companies About ATED Valuations

Owners may not be aware of the risks ... |      |

| The New Register Of Overseas Entities

The UK Goverment takes it very seriously ... |      |

![Click here to view (new window/tab)]()

| Where Are We Now With The Mini Budget?

It seems to change by the day ... |      |

| HMRC Enquiries On The Increase

As business returns to normal ... |      |

| When Is A Partnership Not A Partnership?

When you don't document it correctly ... |      |

| Sterling Falls After Chancellor Announces New Growth Plan

Fallout from Kwasi Kwarteng's announcement ... |      |

| The Benefits Of Company Pension Contributions

Extracting income from your limited company ... |      |

| HMRC Vs Private Hire Taxi Drivers

Over 4,000 fail to pay the right tax ... |      |

| When To Charge The Reduced Rate Of VAT

And when to charge at the standard rate ... |      |

| Capital Gains Tax: Are You One Of The Estimated 26,500?

Have you paid on your property gains? |      |

| Did You Rent Property During The Commonwealth Games?

You may receive a letter from HMRC soon ... |      |

| What Are The Penalties For Failure To Register A Trust?

Probably none for an innocent mistake ... |      |

| Capital Gains Tax: What Is Classed As Residential Property?

How about an orchard? |      |

| HMRC Mileage Rates Vs The Increasing Cost Of Fuel

Are you thinking of paying an excess? |      |

| HMRC Enquiries: What To Do When They Get In Touch!

The most important thing is not to panic ... |      |

| Tax Relief Available On Loans To Traders

There isn't a time limit ... |      |

| Key Tax Considerations When Buying A Holiday Home

There are ways to manage tax exposure ... |      |

| Inheritance Tax Benefits Of Property Investment Companies

A very affordable tax planning option ... |      |

| Period Of Grace Elections For Furnished Holiday Lettings

HMRC now includes unforeseen circumstances ... |      |

| HMRC To Widen Exemptions For Small Trusts And Estates

It'll mean more will not pay tax ... |      |

| HMRC Issues Guidance On The IHT Nil-Rate Band

Start by quantifying the potential liability ... |      |

| National Insurance Increase Affects Dividends

When 1.25% translates into 17% ... |      |

| Basis Period Reform: The Problem With Estimated Figures

Accepting a degree of error? |      |

| Remember To File Your Employment Related Securities Return

The deadline is fast approaching ... |      |

| HICBC: The High Income Child Benefit Charge Threshold

The threshold was never increased ... |      |

| Benefits Of The Share For Share Exchange Rules

More complex than it seems ... |      |

| What Is The Optimum Directors Salary For This Tax Year?

Not what you think ... |      |

| P87: HMRC Formalises Employment Expenses Claims

Mandatory from the 7th of May 2022 ... |      |

| What Is A Family Investment Company?

Or just FIC for short ... |      |

| Investors' Relief: Attracting Investment Into Business

Introduced in the Finance Act 2016 ... |      |

| HMRC Continues To Target Buy-To-Let Landlords

Do you know your tax liabilities? |      |

| Have You Got Your Tax Plan In Place?

The very heart of your financial future ... |      |

| HMRC Looking To Speed Up Self-Assessment Registrations

Bringing registration dates into line ... |      |

| Tax Loophole Closed On Furnished Holiday Lets

A loophole created by the Government itself ... |      |

| The Rent-A-Room Scheme Explained

A source of tax-free rental income ... |      |

| All About The Landlord Borrowing Trap

Known as the Osborne Tax ... |      |

| Taxation Of Serviced Accommodation

The benefits and disadvantages ... |      |

| An Accountant Or A Tax Advisor

Which one is right for you? |      |

| Changes To Inheritance Tax Reporting Requirements

A welcome relief to many ... |      |

| Closing A Stamp Duty Land Tax Loophole

Regarding mixed property purchases ... |      |

| Treating Your Staff And Customers At Christmas

Be careful how much you spend ... |      |

| HMRC Are Sending Nudge Letters About Cryptocurrency

If you get one, speak to your tax advisor ... |      |

| Are You Behind With Your Tax Bills?

Expect HMRC's approach to change soon ... |      |

| CGT Filing Deadline Extended To 60 Days

Following on from the budget ... |      |

| HMRC Is Collecting Information On You!

Very, very detailed information ... |      |

| Increase In The Taxation Of Dividends

Changing from April 2022 ... |      |

| Important Changes To The Reporting Of Non-Taxable Trusts

Register via the Trust Registration Service ... |      |

| Expat Landlords Disclose Undeclared Rental Income

248 have come forward so far ... |      |

| Overview Of The Health And Social Care Levy

Or the Care Tax as politicians are calling it ... |      |

| Inheritance Tax Residence Nil-Rate Band

A very valuable relief ... |      |

| Methods HMRC Uses To Find Out About Rental Properties

They are quite determined ... |      |

| Private Residence Relief And Eligible Periods Of Absence

Have you been away for an extended period? |      |

| HMRC Tax Penalties Are About To Change

Welcome to the new points system ... |      |

| Basis Periods To Be Abolished Due To Making Tax Digital

MTD for Income Tax is coming in 2023 ... |      |

| Dividend Payments During The Pandemic

A lot of directors haven't considered the legality ... |      |

| Failure To Report SEISS Grants Correctly Causing Delays

This could cause fines and penalties ... |      |

| IT Contractor Loses Latest IR35 Case

Could he have been substituted? |      |

| Reviewing Your PAYE Settlement Agreement For COVID-19

PSAs remain active until cancelled ... |      |

| What CGT Is Payable On The Sale Of A Property Post-Death?

It depends on who is selling ... |      |

| Why Didn't The Annexe Qualify As A Separate Dwelling?

Multiple Dwellings Relief did not apply ... |      |

| The Non-Resident Test For Employees Stranded In The UK

A really useful update ... |      |

| Treasury Consultation On New Property Developer Tax

Funding the removal of unsafe cladding ... |      |

| COVID Loss Relief Carry Back Extension

For both companies and unicorporated businesses ... |      |

| HMRC Sends Out Self-assessment Verification Letters

Though you don't have to respond to them ... |      |

| How A Cryptocurrency Is Taxed In The United Kingdom

Trading and investing in the likes of Bitcoin ... |      |

| Stamp Duty Land Tax On Uninhabitable Properties

Potentially good news for developers ... |      |

| What Are The Benefits Of An Employer-Provided Electric Car?

Time to make the leap ... |      |

| Update On SDLT For Non-Residents Buying UK Property

Starts on 1st April 2021 ... |      |

| The Delayed Domestic Reverse Charge For VAT

Starts in March 2021 ... |      |

| HMRC Suspends Filing Penalties Until 28 February

Benefitting up to 3 million ... |      |

| IR35: Off-Payroll Working In The Private Sector

New rules apply from the 6th April 2021 ... |      |

| The Statutory Residence Test And COVID-19 Restrictions

For those stuck in the UK ... |      |

| Capital Gains Tax: Proposed Changes Could Affect Share Sales

Time to move your plans forward? |      |

| HMRC Proposed Changes To Tackle CIS Abuse

Correcting errors and omissions ... |      |

| How To Have A Christmas Party In 2020

Tax-free fun in the pandemic ... |      |

| HMRC's Let Property Campaign

Are you an accidental landlord? |      |

| The Coronavirus Pandemic And Unplanned UK Workdays

HMRC provides further guidance ... |      |

| Car Or Van? Court Finds In Favour Of HMRC

It has always been a confusing situation ... |      |

| Transferring Business Assets On Divorce

HMRC changes guidance ... |      |

| Should You Register As Self-Employed Or A Limited Company?

Are You Starting A Business? |      |

| Airbnb Exchanges Information With HMRC

Have you declared your rental income? |      |

| Mitigating Property VAT Costs For Landlords

Is your tenant struggling to pay? |      |

| Important Update To The Trust Registration Service

Notification is now online only ... |      |

| Have You Overpaid Stamp Duty Land Tax?

SDLT is a complicated area ... |      |

| Resurfacing A Haulage Yard: Repair Or Capital Improvement?

A First Tier Tribunal decides ... |      |

| Proposed Tax Rises To Pay For Impact Of Coronavirus

It's all just speculation until the Autumn Statement ... |      |

| HMRC: Proposed Financial Institution Notice

They do need your agreement ... |      |

| HMRC Are On The Look Out For Furlough Fraud

Have you accidentally overclaimed? |      |

| MTD Extended To Self-Employed And Landlords From 2023

There will be five new reporting obligations ... |      |

| Capital Gains Tax Consultation Underway

Should be acted upon at the Autumn Budget ... |      |

| 2% SDLT Surcharge For Non-UK Resident

Being introduced in 2021 ... |      |

| Holiday Lets, Serviced Accommodation And The 5% VAT Rate

This will have a positive effect on the market ... |      |

| Chancellor's SDLT Boost For UK Property Investors

It's a stamp duty holiday ... |      |

| Payment On Account: Deferring the 31st July Tax Payment

Are you struggling to pay? |      |

| Have You Forgotten Your Capital Gains Tax Return?

Penalties if you fail to file within 30 days ... |      |

| SDLT: Stamp Duty Land Tax Surcharge On Derelict Properties

Are you due a rebate? |      |

| Remember To File Your Employment Related Securities Return

If you have employee shares or share options ... |      |

| Second Self-Employed Income Support Scheme Announced

SEISS round two ... |      |

| HMRC Wins In-Specie Pension Contributions Appeal

This has substantial implications for the pensions industry ... |      |

| Extension To Time Limit To Notify HMRC Of An Option To Tax

It's only temporary, but quite useful ... |      |

| HMRC Loses Another Employment Status Case

IR35 shown the red card ... |      |

| Working From Home: What Tax Reliefs Are Available?

For both employees and the self-employed ... |      |

.jpg)

| Update On The Trust Registration Service (TRS)

More clarification is still needed ... |      |

| Update On Capital Gains Tax And Property

Where are we now? |      |

| Update On The Self-Employed Income Support Scheme

Are you going to be eligibile? |      |

| Coronavirus Job Retention Scheme Portal Opens On 20 April!

Payments should be made by the end of the month ... |      |

| Support For Operators Of FHLs And Serviced Accommodation

What help is available for you during the Coronavirus outbreak? |      |

| The Coronavirus Job Retention Scheme Explained

Paid on a per employment basis ... |      |

| HMRC Time To Pay Arrangements To Help Taxpayers

A very welcome concession ... |      |

| Stamp Duty Land Tax: Surcharge For Non Resident Purchasers

Takes effect from the 1st April 2021 ... |      |

| Entrepreneurs' Relief: Do You Charge Your Company Rent?

What happens when you own your premises ... |      |

| Jointly Owned Property And The Use Of HMRC Form 17

Income Tax vs Capital Gains Tax ... |      |

| The 2020 Annual Tax on Enveloped Dwellings Filing Deadline

The 30th April is fast approaching ... |      |

| Should I Make A Disclosure To HMRC?

Yes! As soon as you can ... |      |

| Changes To The Trust Registration Service

About the proposed new legislation ... |      |

| Government To Make Changes To The Loan Charge

Following an independent review ... |      |

| Company Car Tax Changes In 2020

Some pretty significate changes ... |      |

| Time Is Running Out For Tax Planning Opportunities

Speak to your tax adviser soon ... |      |

| Can My Limited Company Pay My Mortgage?

What about other expenses? |      |

| Have You Declared Pension Growth On Your Tax Return?

You could get a huge tax bill if you haven't ... |      |

| How To Extract Profits From Your Limited Company

Using a salary or by taking dividends ... |      |

| IR35 Employment Status: Contractor Or Employee?

Have you completed your CEST assessment yet? |      |

| Tribunal Considers What Is A Property Development Trade

Can ATED be claimed on a one-off improvement? |      |

| Brexit: What Are The Potential Tax Consequences?

Whatever happens, we need to be prepared ... |      |

| Capital Gains Tax: PPR And The Main Residence Election

Let's get flipping ... |      |

| Inheritance Tax: Is It Time For A Change?

The Office for Tax Simplification recommends ... |      |

| Taxman Wins Landmark IR35 Case Against BBC Presenters

The presenters say they were forced into PSCs ... |      |

| Builders: A Useful VAT Concession In A Recession

Changing from selling to renting your new build ... |      |

| Ownership Of A Company's Business Premises

What are the benefits and pitfalls? |      |

| Family Will Planning: Using The Nil-Rate Band On First Death

To be effective, It needs to be used properly ... |      |

| Domestic Reverse Charge for VAT Delayed!

The construction industry breathes a sigh of relief ... |      |

| Claiming Loan Interest Relief

Accurate records could save you tax ... |      |

| Landlords And The HMRC Property Tax Campaign

Have you made your declaration yet? |      |

| SMEs Unaware Of Increased Annual Investment Allowance

Now's the time to consider some plant and equipment purchases ... |      |

| Common Reporting Standard: HMRC Collects £122m So Far!

And is following up on a further £560 million more ... |      |

| Inheritance Tax Relief For Losses On Shares

The alarm bells are ringing ... |      |

| Off-Payroll Working Rules In The Private Sector

Draft Legisation has been published ... |      |

| PPR Relief On The Sale Of Part Of Your Garden

It could help fund your retirement ... |      |

| Have You Received A Nudge Letter From HMRC Recently?

You're going to need urgent tax advice ... |      |

| The Owner-Managed Business Property Tax Trap

It's easy to fall into ... |      |

| Are You Missing Those Valuable Stamp Duty Land Tax Reliefs?

It's got a whole lot more confusing ... |      |

| An Update On The Domestic Reverse Charge For VAT

Is your construction business ready? |      |

| Caught By The High-Income Child Benefit Charge?

Why you should still register ... |      |

| The Annual Allowance And The NHS Pension Scheme

Are you a high-earner? You could be affected ... |      |

| Can A Director Also Be A Consultant To Their Own Company?

The directors said yes, HMRC said no ... |      |

| Structures And Buildings Allowance Update

HMRC has now published its draft guidance ... |      |

| Capital Gains Tax: Increases For Landlords Are On The Way!

You've got until 6th April 2020 ... |      |

| Transferring Property Tax Efficiently Using Trusts

Ensure you get the right tax advice ... |      |

| How Should You Own Your Business Premises?

There are various tax implications ... |      |

| No Deal Brexit: For UK Employees Working In The EU, EEA Or Switzerland

Will double social security payments be required? |      |

| Maximising The Claim For Business Expenses

Make sure you claim the right expenses ... |      |

| Family Investment Companies And Succession Planning

Sometimes better than a trust ... |      |

| Tax-Free Perks! Did You Know There Were Such Things?

Are you overlooking your trivial benefits? |      |

| A Valuable Inheritance Tax Relief

You may not need to wait seven years ... |      |

| Extracting Money From The Family Business

Care must be taken not to fall foul of HMRC rules ... |      |

| The Importance Of Employer Pension Contributions

In owner managed businesses ... |      |

| Year End Tax Planning For Capital Gains Tax

Minimising your liability ... |      |

| Alphabet Shares And Planning For Family Companies

Be careful how you allocate dividends ... |      |

| Uber Driver's Employment Status Confirmed By Court

Be mindful of the extra costs and liabilities you may occur ... |      |

| Will Bitcoin Profits Mean A Bumper Year For HMRC?

You may be liable for Capital Gains Tax ... |      |

| Tax Planning With A Group Structure

A great way to protect your valuable assets ... |      |

| Stamp Duty Land Tax On The Granny Annexe

Complicated, but there are exemptions ... |      |

| Different Ways To Save For Your Future

Where's best to invest? |      |

| Wishing You All A Very Merry Christmas

Here's some fun tax trivia for you ... |      |

| Should I Tell HMRC About The Buy-To-Let Property I Own?

Yes you should, regardless of the income ... |      |

| Planning For CGT Main Residence Relief

On the sale of a second home ... |      |

| New Structures And Buildings Allowance

For commercial property only ... |      |

| The Tax Pitfalls Of The Office Christmas Party

Be careful of the cost per person ... |      |

| New VAT Rules For Businesses In The Construction Industry

The new reverse charge is quite a doozy ... |      |

| Autumn Budget 2018: Property Tax Changes

SDLT and CGT are both affected ... |      |

| Potential Budget CGT Relief For Sales To Long-Term Tenants

Will this 'good landlord' proposal make it into the Budget? |      |

| The Annual Allowance For Pension Contributions

Are you worried you're paying in too much? |      |

| Marriage Allowance: A Million Couples Are Missing Out!

Are you married or in a civil partnership? |      |

| 40% Of Small Businesses Are Resistant To Making Tax Digital

It's mandatory from April 2019 ... |      |

| HMRC Has Offshore Tax Evaders In Their Sights

And they know all about you ... |      |

| Letting A Room Through Airbnb

HMRC will know about it ... |      |

| Can An FHL Business Qualify For Business Property Relief?

What are the circumstances where it can? |      |

| HMRC And The High Income Child Benefit Charge

Did you even know about it? |      |

| HMRC And Undeclared Gains On Sale Of Second Properties

Have you made a profit and not told them? |      |

| Capital Gains Tax: Buy-To-Let landlords To Be Hit Again

HMRC proposes changes to the payment window ... |      |

| HMRC Restricts Non-Statutory Clearance Process

No more safety net ... |      |

| How To Lose Principal Private Residence Relief

There are a number of pitfalls ... |      |

| Rental Property: To Furnish Or Not To Furnish?

Or even part furnish ... |      |

| The Tax Implications Of Employing Family Members

Make sure you have documentation ... |      |

| Pre-Letting Expenditure: What Can you Claim?

It's easy to fall into the capital expenditure trap ... |      |

| More Tax Changes Affecting Buy-To-Let Landlords

About the new cash accounting rules ... |      |

| Inheritance Tax: Can You Gift Your Home To Your Children

And continue to live there? |      |

| UK Register of Beneficial Owners of Overseas Entities

by non-UK companies and other legal entities ... |      |

| Wealth Preservation Using Family Investment Companies

Is one the right structure for you? |      |

| Changes To Annual Tax On Enveloped Dwellings For 2018

Do you own residential property in a company? |      |

| Thinking Of Acquiring An Investment Property?

Should you do it personally or via a limited company? |      |

| Do You Have An EFRB or EBT That Hasn't Been Settled?

The deadline to deal with it is fast approaching ... |      |

| Changes To The EIS Advance Assurance Process

Speeding up the application process ... |      |

| What Tax Allowances And Reliefs Are Available?

The tax year is about to end ... |      |

| HMRC Requirement To Correct Deadline Approaching!

You could be named and shamed ... |      |

| Business Expenses: Sole Trader Vs Limited Company

What expenses can each claim? |      |

| Changes To The Taxation Of Termination Payments

New legislation comes into force in April, 2018 ... |      |

| Transferring Property And The Stamp Duty Land Tax Trap

It's easy to fall into, but equally avoidable ... |      |

| Transferring Shares To Your Spouse

It has to be done the right way ... |      |

| Do I Need To Let HMRC Know About The Property I Let Out?

Yes. you most definitely do ... |      |

| HMRC Disclosure Campaigns Raise Over £1.2 Billion

Have you any undeclared income or overstated expenditure? |      |

| The New Essendon Tax Website Has Launched!

Find out more about what we do ... |      |

| Borrowing Money From Your Company

It may not be as interest-free as you think ... |      |

| Ensuring Capital Treatment On Purchase Of Own Shares

Can a company buy back its shares? |      |

| The Importance Of Tax Planning For Your Family

Making the most of your allowances ... |      |

| Property Tax Changes In The Autumn Budget 2017

It's not just about house building ... |      |

| Investing In Student Accommodation For Your Children

There are ways to minimise the tax due ... |      |

| The Statutory Residence Test And Working Abroad

It's easy to fall foul of ... |      |

| ATED: Annual Tax On Enveloped Dwellings

Are your properties now affected? |      |

| Inheritance Tax And The Residence Nil Rate Band

It's a complicated piece of legislation ... |      |

| The Importance Of Getting Your Paperwork Right

And the consequences of getting it wrong ... |      |

| HMRC's Trust Registration Service

Do you need to register? |      |

| Business Investment Relief For Non-UK Domiciles

Do you qualify? |      |

| Principal Private Residence Relief

Do you have more than one residence? |      |

| Business Property Relief And Furnished Holiday Lettings

A quick look at HMRC vs Ross ... |      |

| A Brief Guide To Furnished Holiday Lettings

There are both advantages and disadvantages ... |      |

| Buy To Let Tax Relief On Repairs And Replacements

There's a lot of room for interpretation ... |      |

| Selling A UK Rental Property

What's your tax going to be? |      |

| Liquidations And Phoenixing

Do you know your tax position? |      |

| Business Property Relief And Inheritance Tax

It's a very valuable tax relief ... |      |

| How Do You Obtain Income Tax Relief For Losses?

I know you want to make a profit, but ... |      |

| Property Tax: Loan Interest Relief Restrictions

You may need to re-evaluate your property business ... |      |

| Transferring A Property Letting Business To A Company

What's the tax going to be on that? |      |

| Raising Funds Under The Enterprise Investment Scheme

EIS or Seed EIS? Would you qualify? |      |

| Property Letting: Is It A Business Or An Investment Activity?

You have to consider your activities as a whole ... |      |

| The Basic Principles Of Trusts

More common than you think ... |      |

| Inheritance Tax, NRBs And The Rise Of Gifting

Have you updated your will recently? |      |

| Entrepreneurs' Relief: Do You Qualify?

It can be hugely valuable ... |      |

| Welcome To Essendon Tax Consultancy

The start of my brand new blog ... |      |