No Deal Brexit: For UK Employees Working In The EU, EEA Or Switzerland |

Will double social security payments be required? |

POSTED BY HELEN BEAUMONT ON 17/04/2019 @ 8:00AM

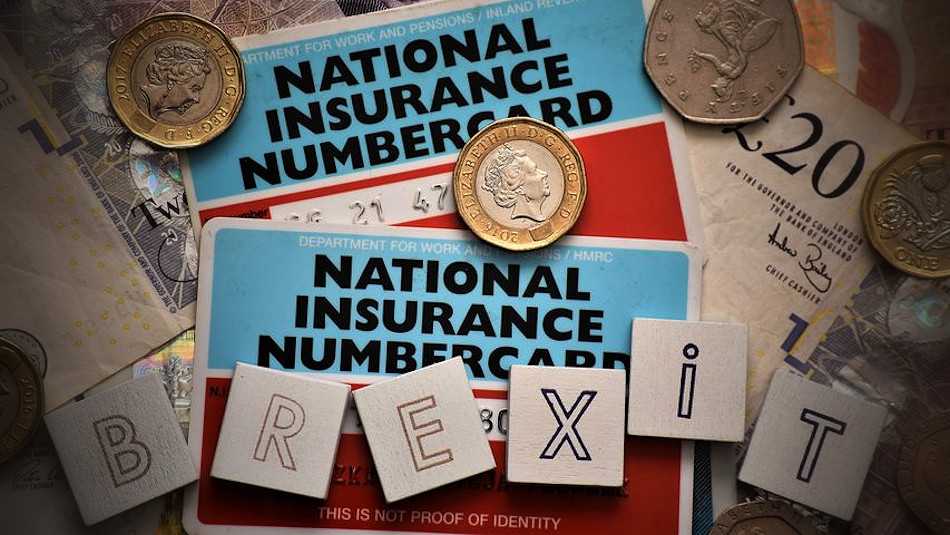

If you're a UK employer with staff working in the EU, EEA or Switzerland, then HMRC has issued new no deal Brexit guidance ...

In case of a no deal Brexit, employers need to check to see if their employees will be paying NIC and social security!

Currently, your employees only need to pay social security contributions into the social security system of one country. But if the UK leaves the EU without a deal, this coordination will end.

"This means that employees may be liable to both UK National Insurance contributions and social security in the country they work in!"

HMRC advises that UK NIC will need to be paid if the employee has an A1/E101 form in place. Contributions will continue for the duration showing on the form. If the end date is beyond the date the United Kingdom leaves the EU, employers should contact the relevant EU, EEA or Swiss authority to discover whether both the employer and/or employee needs to make contributions in that country's social security system.

However, HMRC has confirmed that the social security position for UK nationals (in Ireland) and Irish nationals in the UK will not be impacted by no deal Brexit as the two countries have various bilateral employment agreements in place.

To ensure UK workers only pay social security contributions in one country, the Government hopes to agree an EU wide reciprocal agreement with the EU, EEA and Switzerland, though this may not be in place by the time the UK leaves with a no deal so a new A1/E101 will be required.

"Would you like to know more?"

Double social security contributions will not be welcome so employers should take action now. If you'd like to find out more about NIC and social security requirements for your employees in the event of a no deal Brexit, then do give me a call on 01908 774323 or click here to ping me an email and let's see how I can help you.

Until next time ...

HELEN BEAUMONT

Join my mailing list! Click here and be one of the first to know when I publish a new blog post!

Leave a comment ... |

More about Helen Beaumont ... | ||

|