Property Tax: Loan Interest Relief Restrictions |

You may need to re-evaluate your property business ... |

POSTED BY HELEN BEAUMONT ON 14/07/2017 @ 8:00AM

It has been known for a while about the impact that loan interest relief restrictions will have on residential landlords. However, it still surprises me the number of people that I meet that have not yet considered how this will impact on their finances ...

Your property tax bill may rise considerably over the next few years!

copyright: andreypopov / 123rf stock photo

So why might this be? 2017/18 is the first year of the restriction and so landlords will not yet be feeling the bite. Combine this with the fact that interest rates are low, so while the increase in tax will undoubtedly hurt, it may just be bearable.

However, with interest rates predicted to rise in 2018, things may become painful!"

So what are the tax changes? Well, in the Summer Budget 2015, it was announced that new rules would be introduced to cap tax relief on mortgage interest, for residential property landlords.

Tax relief is to be restricted to the basic rate of 20% and individuals with properties that meet the definition of a furnished holiday let will be unaffected by these changes.

The changes are being phased in over 4 years and started in April 2017 as follows:

Tax Year 2017/18 - 75% finance costs relievable, 25% restricted to basic rate

Tax Year 2018/19 - 50% finance costs relievable, 50% restricted to basic rate

Tax Year 2019/20 - 25% finance costs relievable, 75% restricted to basic rate

Tax Year 2020/21 - All at basic rate

Significant additional costs will arise as a result of these changes, particularly for those that own property portfolios that are highly geared.

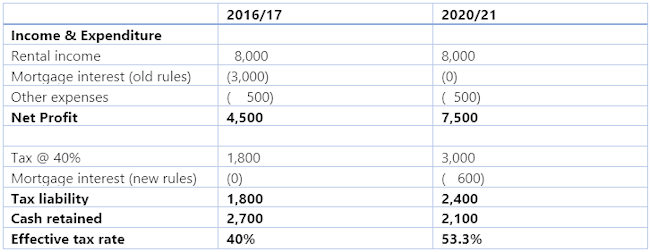

To help illustrate the effect of the changes for higher rate taxpayers, the following example compares the taxation of rental profits in 2016/17 with 2020/21. Let's say that Ted owns a single unfurnished buy to let property and is a 40% tax payer:

In this case, whilst Ted's liability will increase, he still has cash in his pocket. However, for some landlords who have a portfolio of properties which are very highly geared may, as a result of these changes, be out of pocket after tax.

"These landlords will need to assess the viability of their business going forward!"

One of the options open to such a landlord is considered in my blog post called Transferring a Property Letting Business To A Company and for further advice, do give me a call on 01908 774323 or click here to send me an email enquiry and I'll see how I can help you.

Until next time ...

HELEN BEAUMONT

Join my mailing list! Click here and be one of the first to know when I publish a new blog post!

Leave a comment ... |

More about Helen Beaumont ... | ||

|