The 2020 Annual Tax on Enveloped Dwellings Filing Deadline | The 30th April is fast approaching ... |

POSTED BY HELEN BEAUMONT ON 19/02/2020 @ 9:00AM #SME #Tax #MiltonKeynes #UK A limited company, regardless of whether it is registered in the UK or not, has to pay Annual Tax on Enveloped Dwellings if it owns residential property valued over £500,000 in the UK ... A limited company, registered in the UK or not, has to pay Annual Tax on Enveloped Dwellings on UK residential property! copyright: andreypopov / 123rf The Annual Tax on Enveloped Dwellings (ATED) tax year is 1st April to 31st March and companies must file a return by 30 April for each ATED year during which they held residential property in the United Kingdom.

"If you feel reliefs are available (commonly Property Rental Business Relief), then an ATED relief return must be submitted!"

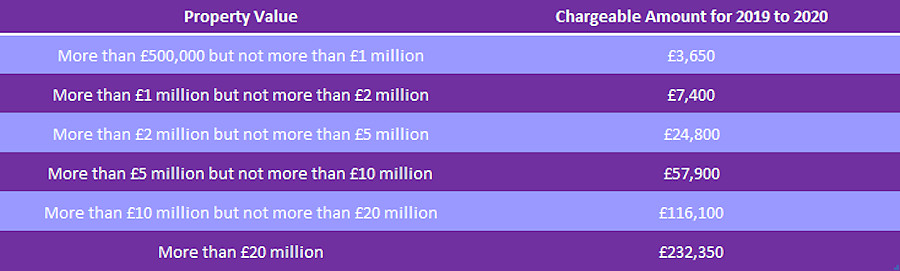

The company is liable to pay an annual chargeable amount based on the value as of 1st April 2017 or the value at the date it was acquired if later than that.

The annual chargeable amounts usually increase in line with the previous September's consumer price index (CPI). However, in 2015, the government decided to increase the annual chargeable amounts by an additional 50%.

As these property value bands are not index-linked, more and more properties will come within the scope of the ATED and will be liable to more substantial annual charges as time goes on.

Up until 5th April 2019, NRCGT only applied to tax gains realised by non-residents on the disposal of UK residential property (aligned with Annual Tax on Enveloped Dwellings which only applies to UK residential property interests).

From 6th April 2019 this was extended to also tax:

Gains arising from disposals of UK commercial properties Disposals of interests in 'property-rich' entities where the non-resident person holds (or has held in the last 2 years) a 25% or greater interest in the company. Property-rich entities include companies that derive 75% or more of its gross asset value from UK property (both residential or commercial).

Rebasing is available to the April 2019 value where the taxable property is only brought into charge for capital gains tax as a result of these new rules. Until next time ...

HELEN BEAUMONT

Would you like to know more? If anything I've written in this blog post resonates with you and you'd like to discover more, it may be a great idea to give me a call on 01908 774323 and let's see how I can help you. About Helen Beaumont ... |  | | Helen brings the personal tax planning experience of the top 20 tax companies to Essendon. Formerly of MacIntyre Hudson (with 45 offices nationwide), Helen worked at Chancery for more than 10 years before joining Essendon as the personal tax specialist.

Tax Planning can make a considerable difference to your tax liability. Helen has specialist knowledge and experience in tax planning and uses every opportunity to minimise your tax bill is utilised. By analysing your investments, income, profit and expenditures, Helen will provide strategic tax planning expertise that could offer significant savings, whilst delivering clear, honest advice and guidance.

When Helen is not at Essendon she spends time with her young son and likes going on long walks with the family dog. |

|

More blog posts for you to enjoy ... | | | | | | | | |

|