HMRC Taking A Good Look At Savvy Online Sellers

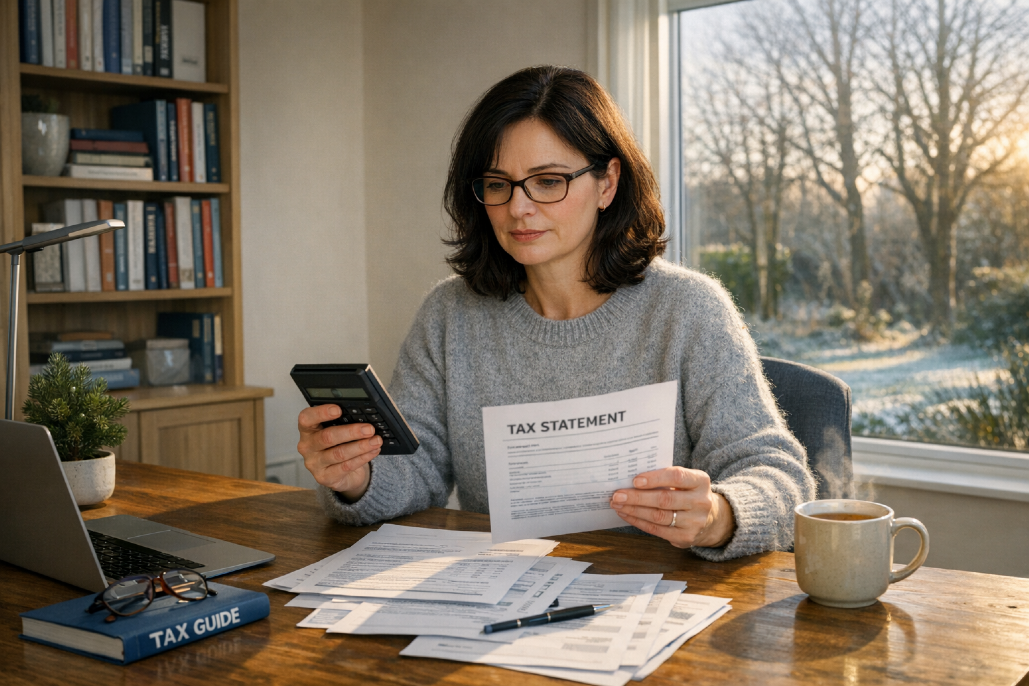

HMRC's new data sharing initiative, which aligns with the OECD's global objective to tackle tax evasion, has been met with mixed reactions from online sellers ... It's crucial for online sellers to ensure that their income is accurately reported! While some see it as a necessary step towards ensuring fair taxation, others are concerned about the potential invasion of privacy and increased scrutiny from tax authorities. Under this initiative, online platforms such as Etsy, Vinted, eBay, and even social media platforms like Instagram and OnlyFans, are now required to collect sales and income information from their sellers and share it with HMRC. This means that any income earned through these platforms | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Would you like to know more? |

If anything I've written in this blog post resonates with you and you'd like to discover more about accurately reporting your online seller activity, it may be a great idea to give me a call on |

Share the blog love ... | |||||||||||||||||||||||

#HMRC #taxevasion #datasharing #onlinesellers #globalobjectives |

About Helen Beaumont ... | ||

|

More blog posts for you to enjoy ... | ||

| The 2026 changes to Inheritance Tax: what families need to know Here's the practical view on the changes to Inheritance Tax in 2026, and why 'frozen' can still mean 'costly'. It covers the sticking points around thresholds, new relief limits for businesses and farms, and why AIM and pensi... | |

| Why HMRC's cryptoasset disclosure service has raised only £4m so far HMRC's cryptoasset disclosure service has brought in only about £4m, despite tens of thousands of nudges. That gap hints at low awareness, wishful thinking, or simple avoidance. This is what it means for crypto tax, and why a... | |

| Top tax tips for smart year-end tax planning before April Here are top tax tips to tidy up savings, ISAs, pensions and gains before April. It's a friendly run-through of what people miss and how to fix it. Think of it as a quick chat that could save real money ...... | |

| Ground rents to be capped: what the new £250 limit means Ground rents will be capped at £250 from 2028, and the rules mostly target future homes rather than existing leases. It's part of wider leasehold reform and a push towards commonhold.The direction is clearer, but today's leas... | |

| Why late tax return penalties keep rising as HMRC clamps down Late tax return penalties are rising because more tax goes unpaid, and HMRC is pushing harder. If you're late, the costs can stack up quickly, but you can sometimes challenge mistakes or agree on a payment plan. So always act... | |

| Can't pay your self-assessment bill by the 31st of January? If you can't pay your self-assessment bill by the 31st of January, don't hide from it. Get the numbers right, pay what you can, and talk to HMRC early about a time to pay arrangement. You'll usually reduce late payment penalt... | |

| UK tax returns and the mid-year Capital Gains Tax rate change in 2024/25 The mid-year Capital Gains Tax rate change means HMRC's online return may miscalculate CGT after the 30th of October 2024. Taxpayers may need to compute an adjustment and enter it manually. A careful check now can prevent und... | |

| New Year Nudge: Beat the self-assessment filing deadline without stress Here's the simple reality of the self-assessment filing deadline: it doesn't move, but your stress can. My blog post this week explains why filing early helps, what HMRC charges for delays, and how an online tax return can ke... | |

Other bloggers you may like ... | ||

| Moving to Milton Keynes: how Short Stay : MK makes relocation simple Posted by Emily Freeman on https://blog.shortstay-mk.co.uk Moving to Milton Keynes can feel like a lot, especially while you're job-starting and house-hunting at the same time. Short Stay : MK gives you a prac ... | |

| Top tips to beat the existential dread of a Sunday evening Posted by Dave Cordle on https://blog.davecordle.co.uk You're not broken for feeling the existential dread of a Sunday evening. This post shows you how to reduce Sunday anxiety, reset your approach to Mond ... | |

| How higher taxes delivered a record government surplus in January Posted by Roger Eddowes on https://blog.essendonaccounts.co.uk The record government surplus in January came from higher tax receipts, rather than lower public spending. It looks like a strong month, yet public fi ... | |

| Practical ways an Online PA can support landlords Posted by Sarah Hannaford on https://blog.sarahpasolutions.co.uk Here's how an Online PA can support landlords without the stress. Keep paperwork, deadlines, and tenant updates moving in the right order. It's practi ... | |