Do I need to file a self-assessment tax return?

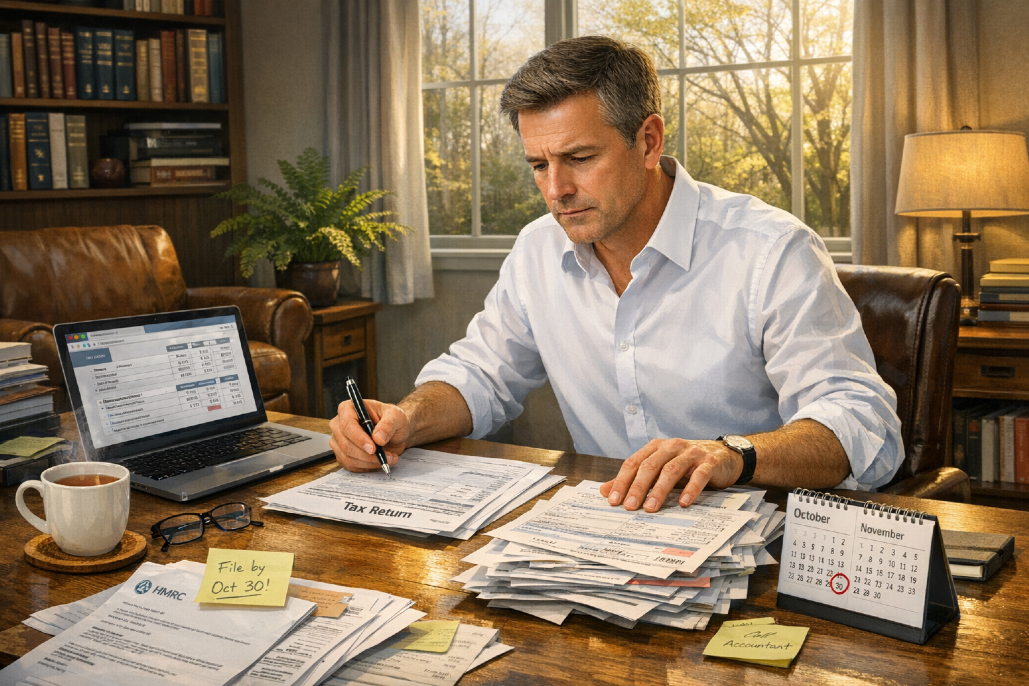

Unsure if you must file a self-assessment tax return? This guide explains who needs to file, what income triggers it, and how to register with HMRC. Get clear before the tax return deadline ... File a self assessment tax return, Crunching numbers tight, Owed or refunded Many people wonder each year whether they need to file a self-assessment tax return, especially if there have been changes, such as starting a side hustle, receiving dividends, or earning rental income. The system relies on individuals understanding their position, so they should calmly assess their income sources. Then you can decide whether registration | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Would you like to know more? |

If anything I've written in my blog post resonates with you and you'd like to discover more of my thoughts about whether you need to file a self-assessment tax return, then do feel free to call me on 07434 287603 and let's see how I can help you. |

Share the blog love ... | |||||||||||||||||||||||

#file a self assessment tax return #SelfAssessment #HMRC #UKTax #TaxReturnDeadline #SelfEmployedTax |

About Helen Beaumont ... | ||

|

More blog posts for you to enjoy ... | ||

| Property Incorporation Relief from April 2026: what changes and why it matters Property incorporation relief is moving from automatic to claims-based from April 2026. That sounds minor, but it changes deadlines, paperwork, and risk if anything is missed. Here's what landlords and advisers should line up... | |

| The 2026 changes to Inheritance Tax: what families need to know Here's the practical view on the changes to Inheritance Tax in 2026, and why 'frozen' can still mean 'costly'. It covers the sticking points around thresholds, new relief limits for businesses and farms, and why AIM and pensi... | |

| Why HMRC's cryptoasset disclosure service has raised only £4m so far HMRC's cryptoasset disclosure service has brought in only about £4m, despite tens of thousands of nudges. That gap hints at low awareness, wishful thinking, or simple avoidance. This is what it means for crypto tax, and why a... | |

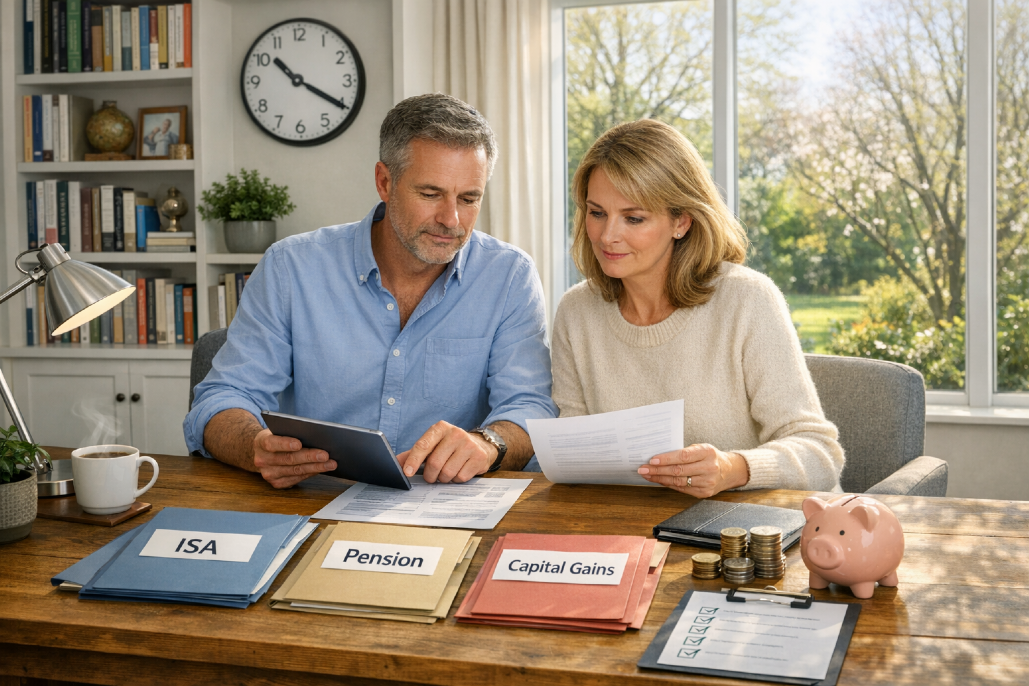

| Top tax tips for smart year-end tax planning before April Here are top tax tips to tidy up savings, ISAs, pensions and gains before April. It's a friendly run-through of what people miss and how to fix it. Think of it as a quick chat that could save real money ...... | |

| Ground rents to be capped: what the new £250 limit means Ground rents will be capped at £250 from 2028, and the rules mostly target future homes rather than existing leases. It's part of wider leasehold reform and a push towards commonhold.The direction is clearer, but today's leas... | |

| Why late tax return penalties keep rising as HMRC clamps down Late tax return penalties are rising because more tax goes unpaid, and HMRC is pushing harder. If you're late, the costs can stack up quickly, but you can sometimes challenge mistakes or agree on a payment plan. So always act... | |

| Can't pay your self-assessment bill by the 31st of January? If you can't pay your self-assessment bill by the 31st of January, don't hide from it. Get the numbers right, pay what you can, and talk to HMRC early about a time to pay arrangement. You'll usually reduce late payment penalt... | |

| UK tax returns and the mid-year Capital Gains Tax rate change in 2024/25 The mid-year Capital Gains Tax rate change means HMRC's online return may miscalculate CGT after the 30th of October 2024. Taxpayers may need to compute an adjustment and enter it manually. A careful check now can prevent und... | |

Other bloggers you may like ... | ||

| Why ''It's Always Worked Before'' Can Break Hospitality IT Overnight Posted by Andrew Parker on https://blog.wolvertonsolutions.com If ''it's always worked before'' is the plan, hospitality IT is already on borrowed time. Demand grows, updates shift, and hardware fades quietly unti ... | |

| Do You Test Your Email Systems Regularly? Posted by Pritesh Ganatra on https://blog.btsuk.net I recently sent an email to someone I had previously corresponded with. When I got a bounce-back, I thought I had the wrong address or made a typo. I ... | |

| Why a small business CRM matters more than ever, and how YourPCM is a practical solution Posted by Your PCM on https://www.yourpcm.uk Running a small business has never been simple. Owners and founders often wear multiple hats, managing customers, following up on leads, sending email ... | |

| Bookkeeping Buddy: Why DIY Bookkeeping Doesn't Mean Doing It Alone Posted by Alison Mead on https://blog.siliconbullet.com Many small business owners attempt DIY bookkeeping to save costs and maintain control. Yet, this path can be daunting. Learn how you can manage your f ... | |