|

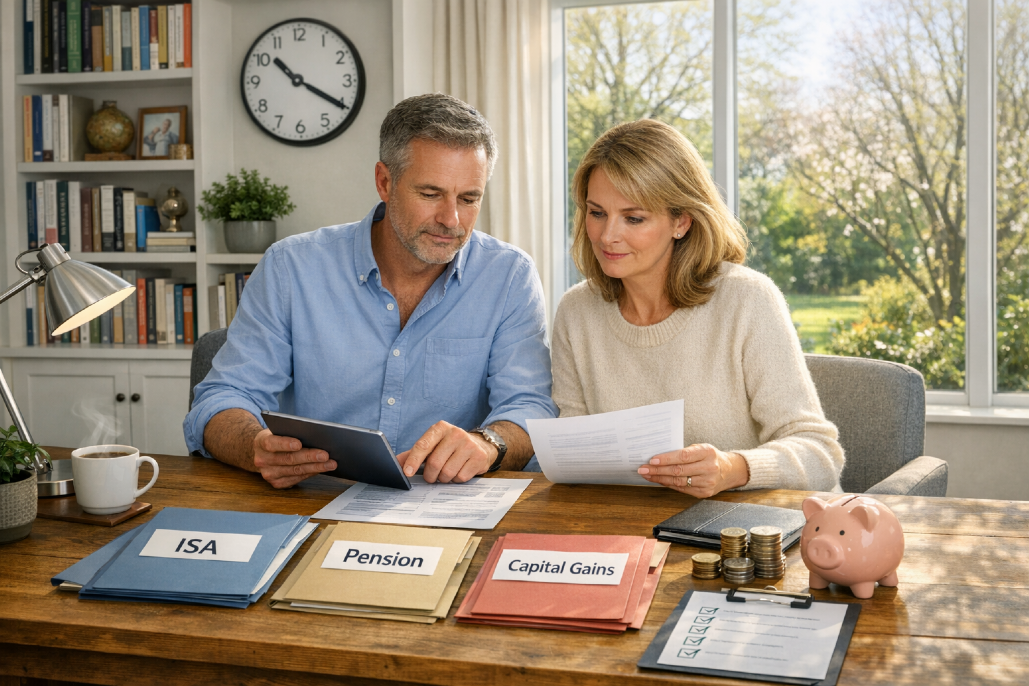

MTD for Income Tax for non-residents: key changes, dates, and what to do If someone lives abroad but still has UK income, the reporting rules are about to shift. MTD for Income Tax brings digital records and quarterly updates, with phased start dates based on gross income. This post explains what changes, who's affected, and how to get ready without panic ... Property Incorporation Relief from April 2026: what changes and why it matters Claim property incorporation relief before April 2026 deadline. Avoid risk and paperwork. Landlords and advisers act now ... The 2026 changes to Inheritance Tax: what families need to know Discover the upcoming changes to Inheritance Tax in 2026 and how they could impact your estate. Learn about thresholds, relief limits, and more ... Why HMRC's cryptoasset disclosure service has raised only £4m so far HMRC's cryptoasset disclosure service has only brought in £4m despite tens of thousands of nudge letters. What does it mean for crypto tax? Top tax tips for smart year-end tax planning before April Top tax tips to save money before April. Learn how to tidy up savings, ISAs, pensions and gains. Don't miss out ... Ground rents to be capped: what the new £250 limit means Ground rents to be capped at £250 from 2028 as part of leasehold reform and commonhold push. Existing leaseholders may need a conversion rout Why late tax return penalties keep rising as HMRC clamps down Late tax return penalties rising due to more unpaid tax. Act early and stay in control. Challenge mistakes or agree on payment plan ... Can't pay your self-assessment bill by the 31st of January? Pay your self-assessment bill on time or face penalties. Don't ignore it - get the numbers right, pay what you can, and talk to HMRC ... UK tax returns and the mid-year Capital Gains Tax rate change in 2024/25 Avoid CGT miscalculations from HMRC after the mid-year Capital Gains Tax rate change on Oct. 30th, 2024. Check now for manual adjustments ... New Year Nudge: Beat the self-assessment filing deadline without stress New year, new admin: the self-assessment filing deadline is 31 January - file early, avoid penalties, and move on ... HMRC Taking A Good Look At Savvy Online Sellers HMRC's new data sharing initiative, which aligns with the OECD's global objective to tackle tax evasion, has been met with mixed reactions from online sellers ... How HMRC Christmas tax rules trip up festive side hustlers HMRC Christmas tax rules explained for festive side hustlers, from thresholds to reporting and deadlines ... Do I need to file a self-assessment tax return? File a self-assessment tax return before the deadline. Learn who needs to file, income triggers, and how to register with HMRC. Get clear now ... Salary sacrifice changes set to hit millions of UK employees Salary sacrifice changes introduce a £2,000 cap, reshaping workplace pensions and tax for millions ... Nine ways to beat the Budget tax burden this year Beat the Budget tax burden with this simple guide. Learn how to save on pensions, ISAs, dividends, and more. Plan ahead and minimize taxes ... Why splitting a business to avoid VAT can backfire badly Avoid issues with HMRC by not splitting your business to avoid VAT. Consider long-term costs and commercial reality before acting ... Chancellor eyes pension salary sacrifice: a £5.1bn question Will the chancellor curb pension salary sacrifice? Here’s what a £5.1bn move could mean for workers and employers ... Why farmers need an inheritance tax transitional gifting rule now Why an inheritance tax transitional gifting rule would protect older farmers before APR/BPR changes bite in April 2026 ... Inheritance Tax risk for family-owned businesses: act before reliefs shrink! Understand Inheritance Tax risk for family owned businesses and the urgent steps to safeguard succession ... A pension tax raid would put the NHS in danger A pension tax raid could drain GP numbers and threaten neighbourhood care ... HMRC launches real-time HICBC payment for smoother PAYE HMRC's real-time HICBC payment lets employees settle the charge through PAYE. It's quick, accurate and avoids self-assessment for many. It's a practical win for households receiving child benefit ... Are directors' loans a good cash flow strategy or just another tax trap? Discover the pros and cons of directors loans. Boost cash flow or risk HMRC attention. Use cautiously for success ... Salary or Dividends: Optimising Income for Directors Optimising income for directors: Find the balance between salaries and dividends while navigating tax changes. Improve your remuneration strategy ... Should Directors Use Salary Sacrifice To Reduce Income Tax And National Insurance? Discover how salary sacrifice to reduce tax helps directors cut NI, boost pensions, and streamline payroll ... UK Unveils Amnesty For Covid Loan Debtors: Your Last Clean-Slate Chance The UK’s new amnesty for Covid loan debtors lets you repay quietly before tougher sanctions arrive ... Understanding The 10-Year Charge On Trusts Without The Headaches Understand the 10-Year charge on trusts, how it’s calculated, deadlines, and how to stay compliant with HMRC ... HMRC Pension Relief Crackdown: What Higher-Rate Taxpayers Need To Know HMRC pension relief crackdown: tighter checks, no phone claims, evidence needed for higher rate taxpayers from Sept 2025 ... Why Inheriting A Pension Could Become Painfully Taxing Inheriting a pension? Learn how it may affect your taxes and how to protect your family's wealth. Avoid the RNRB trap. Practical steps to mitigate Rethinking Taxation: The Case for Taxing Income from Wealth, Not Work Taxing income from wealth gains traction in UK, shifting focus from work. Explore the potential impact of this fiscal policy alternative ... HMRC Warns Against Stamp Duty Rogue Agents: Stay Vigilant! Homebuyers are urged to be wary of rogue agents promoting fraudulent stamp duty repayment claims, following a Court of Appeal decision ... The Ins and Outs of Employing Young People The first thing to consider when employing young people is their age. Children under the age of 13 are not allowed to work except in certain circumstances. However, there are a number of restrictions for all individuals under the age of 18 ... |

| Essendon Tax Independent tax consultants ... |