How HMRC Christmas tax rules trip up festive side hustlers

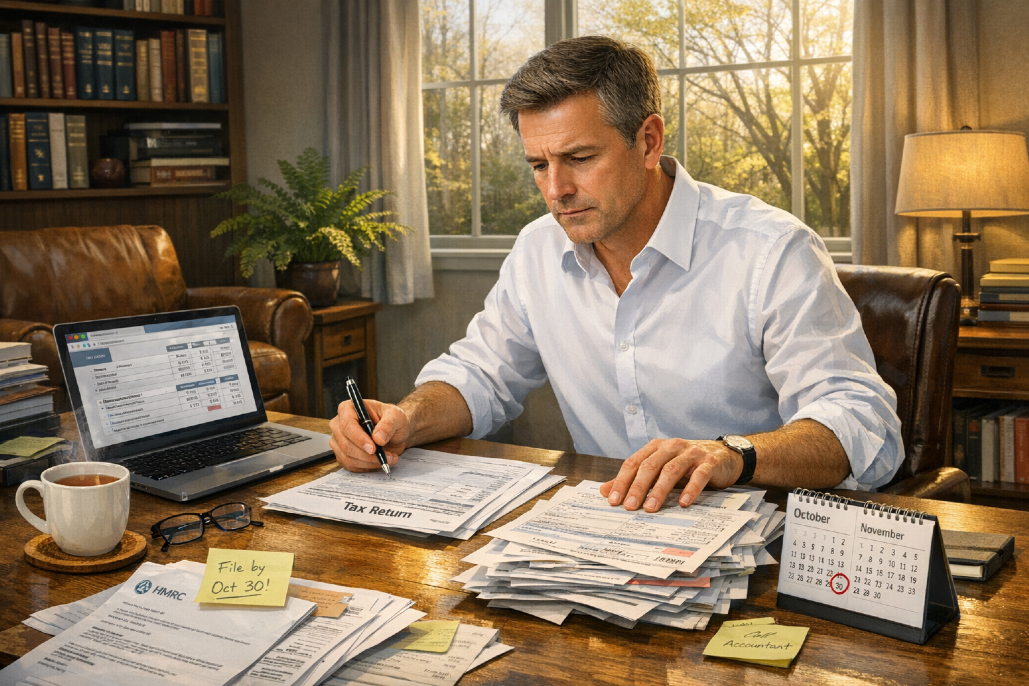

HMRC Christmas tax rules often surprise side hustlers each December. Here's what counts, what doesn't, and when to register. Stay compliant and keep more of your Christmas earnings ... HMRC Christmas tax rules, Complicate the season's joys, Taxes on all gifts Many crafters and artisans assume December profits are too small to matter, but HMRC Christmas tax rules say otherwise, and the details surface just when market stalls get busy and cash boxes fill up. The principle is simple: if total trading income across the tax year tops £1,000, it's time to register as a sole trader, file a return, and plan for the bill. Even if the work feels seasonal and casual!Most people selling handmade gifts, cards, or upcycled finds are running a trading activity rather than clearing clutter, and that distinction drives taxable income. Selling old personal belongings rarely needs reporting, but the moment someone makes items to sell for profit, they step into the territory covered by HMRC guidance. That's where records of costs, dates, and revenue stop being optional and start being essential. The £1,000 trading allowance sounds generous until everything is added up, and many underestimate how quickly Christmas earnings stack up when markets, pop‑ups, and online orders overlap. A person might make £600 at fairs and another £500 via sponsored blog posts; together they exceed the tax thresholds and must register, file, and pay on time. The smarter move is to track all sources from day one, not just in December. Online platforms now feed data to HMRC, which means marketplace sales leave a digital trail whether the seller notices or not. Those who notch up frequent sales and receive payments approaching the figures platforms flag should assume visibility and behave accordingly. It's less about fear and more about predictability: clean records reduce stress when the self-assessment window opens.The deadline dance is predictable too: earnings in the 2024–25 tax year get reported by the 31st of January 2026, so early planning beats last‑minute scrambles. Keeping receipts for materials, stall fees, packaging, and postage not only supports compliance, but also trims taxable income when claimed properly. And don't forget business mileage too, as travelling to and from venues to sell your wares can mean a reduced tax bill. There's no virtue in overpaying because your records | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Would you like to know more? |

If anything I've written in my blog post resonates with you and you'd like to discover more of my thoughts about Christmas hustlers and whether you need to pay tax, then do feel free to call me on 07434 287603 and let's see how I can help you. |

Share the blog love ... | |||||||||||||||||||||||

#HMRCChristmasTaxRules #SideHustleUK #TaxThresholds #ChristmasEarnings #SelfAssessment #HMRCGuidance |

About Helen Beaumont ... | ||

|

More blog posts for you to enjoy ... | ||

| Property Incorporation Relief from April 2026: what changes and why it matters Property incorporation relief is moving from automatic to claims-based from April 2026. That sounds minor, but it changes deadlines, paperwork, and risk if anything is missed. Here's what landlords and advisers should line up... | |

| The 2026 changes to Inheritance Tax: what families need to know Here's the practical view on the changes to Inheritance Tax in 2026, and why 'frozen' can still mean 'costly'. It covers the sticking points around thresholds, new relief limits for businesses and farms, and why AIM and pensi... | |

| Why HMRC's cryptoasset disclosure service has raised only £4m so far HMRC's cryptoasset disclosure service has brought in only about £4m, despite tens of thousands of nudges. That gap hints at low awareness, wishful thinking, or simple avoidance. This is what it means for crypto tax, and why a... | |

| Top tax tips for smart year-end tax planning before April Here are top tax tips to tidy up savings, ISAs, pensions and gains before April. It's a friendly run-through of what people miss and how to fix it. Think of it as a quick chat that could save real money ...... | |

| Ground rents to be capped: what the new £250 limit means Ground rents will be capped at £250 from 2028, and the rules mostly target future homes rather than existing leases. It's part of wider leasehold reform and a push towards commonhold.The direction is clearer, but today's leas... | |

| Why late tax return penalties keep rising as HMRC clamps down Late tax return penalties are rising because more tax goes unpaid, and HMRC is pushing harder. If you're late, the costs can stack up quickly, but you can sometimes challenge mistakes or agree on a payment plan. So always act... | |

| Can't pay your self-assessment bill by the 31st of January? If you can't pay your self-assessment bill by the 31st of January, don't hide from it. Get the numbers right, pay what you can, and talk to HMRC early about a time to pay arrangement. You'll usually reduce late payment penalt... | |

| UK tax returns and the mid-year Capital Gains Tax rate change in 2024/25 The mid-year Capital Gains Tax rate change means HMRC's online return may miscalculate CGT after the 30th of October 2024. Taxpayers may need to compute an adjustment and enter it manually. A careful check now can prevent und... | |

Other bloggers you may like ... | ||

| Why a small business CRM matters more than ever, and how YourPCM is a practical solution Posted by Your PCM on https://www.yourpcm.uk Running a small business has never been simple. Owners and founders often wear multiple hats, managing customers, following up on leads, sending email ... | |

| Bookkeeping Buddy: Why DIY Bookkeeping Doesn't Mean Doing It Alone Posted by Alison Mead on https://blog.siliconbullet.com Many small business owners attempt DIY bookkeeping to save costs and maintain control. Yet, this path can be daunting. Learn how you can manage your f ... | |

| Where is the economy heading, and can enterprise change the story? Posted by Roger Eddowes on https://blog.essendonaccounts.co.uk When I look at the latest economic commentary and data, my honest feeling is that the economy is in a strange place right now. It is not collapsing, b ... | |

| Its been a busy few months! What am I up to now? Posted by Steffi Lewis on https://www.steffilewis.com It has been a while since I wrote a full blog post here. The last one was about a great TV series I'd been watching, and before that, a Christmas one ... | |